The survival of any small business is bound to be marred with severe challenges in a competitive world like today. Udyam registration, offered to many advantages by the Government of India in the case of small businesses across the country. Be running a Micro Small or Medium enterprise, you want to benefit all the government scheme and financial assistant.

In this guide, you’ll learn everything about Udyam Registration – its process, benefits, documents required, and the latest updates.

What is Udyam Registration?

Udyam Registration is a government initiative to provide legal recognition to MSMEs in India. It replaces the earlier Udyog Aadhaar system and simplifies the process for businesses to register as an MSME.

This registration is indispensable for businesses to acquire government schemes, subsidies, and loans. Moreover, it serves to get the businesses noticed by banks and financial institutions for credit facilities.

Benefits of Udyam-Registration

Registering your business under Udyam-Registration has several benefits. Here’s why every MSME should register:

| Benefit | Description |

| Government Subsidies | Registrations of MSMEs can be availed of various subsidies and grants. |

| Easy Bank Loans | Get easy access to loans at lower interest rates. |

| Credit Guarantee | MSMEs can access credit guarantee schemes. |

| Tax Benefits | Registered businesses can avail of various tax exemptions. |

| Protection from Delays | Helps businesses in case of delayed payments from buyers. |

With Udyam Registration, small businesses can grow faster by taking advantage of these government benefits.

Who Can Apply for Udyam Registration?

Any business falling in the MSME category is eligible for Udyam-Registration. The classification has been done on the basis of investment in plant and machinery and annual turnover.

| Category | Investment (₹) | Turnover (₹) |

| Micro | Up to ₹1 crore | Up to ₹5 crore |

| Small | Up to ₹10 crore | Up to ₹50 crore |

| Medium | Up to ₹50 crore | Up to ₹250 crore |

Process for Udyam Registration Step-by-Step

The process of registering your business under Udyam-Registration is simple and entirely online. To register, follow the following steps:

Step 1: Official Udyam-Registration Portal, Visit the website of Udyam -Registration portal at www.udyamregistration.gov.in.

Step 2: Enter Your Aadhaar Number, The registration process requires an Aadhaar number of the business owner or authorized signatory.

- For Proprietorship: Enter the Aadhaar number of the owner.

- For Partnership Firms/Companies : Enter the Aadhaar number of the managing partner or director.

Step 3: Fill in Business Details

Enter all the details such as:

Business Name, PAN Number Address, Mobile Number, Email ID, Type of Organization

Step 4: Select Business Category, Choose whether your business falls in the category of Micro, Small, or Medium based on the investment and turnover.

Step 5: Submit Application, Once all of these details are filled, your application goes for submission. After verification, you obtain your Udyam-Registration Certificate.

Documents Needed for Udyam Registration

The Udyam-Registration process is quite simple, and you require minimal documents. Here’s what you need:

- Aadhaar Card

- PAN Card

- Business Address Proof

- Bank Account Details

- GSTIN (if applicable)

No additional documents are required to upload during the registration process. Just ensure that you enter the correct details.

Latest News on Udyam-Registration (2025 Update)

As of January 2025, the government has made some updates to the Udyam-Registration process:

- GST Requirement: GSTIN is now mandatory for businesses with turnover above the GST threshold.

- Udyog Aadhaar Migration: Businesses registered under Udyog Aadhaar must migrate to Udyam-Registration before the deadline.

- Easier Loan Access: The government has partnered with several banks to offer loans to MSMEs registered under Udyam-Registration at lower interest rates.

Common Mistakes to Avoid During Udyam-Registration

While registering for Udyam, avoid these common mistakes:

- Entering Incorrect Aadhaar Details

- Providing Wrong Business Category

- Skipping PAN or GSTIN Details

- Filing Multiple Registrations for One Business

Ensure you verify your details before submitting the form to avoid delay.

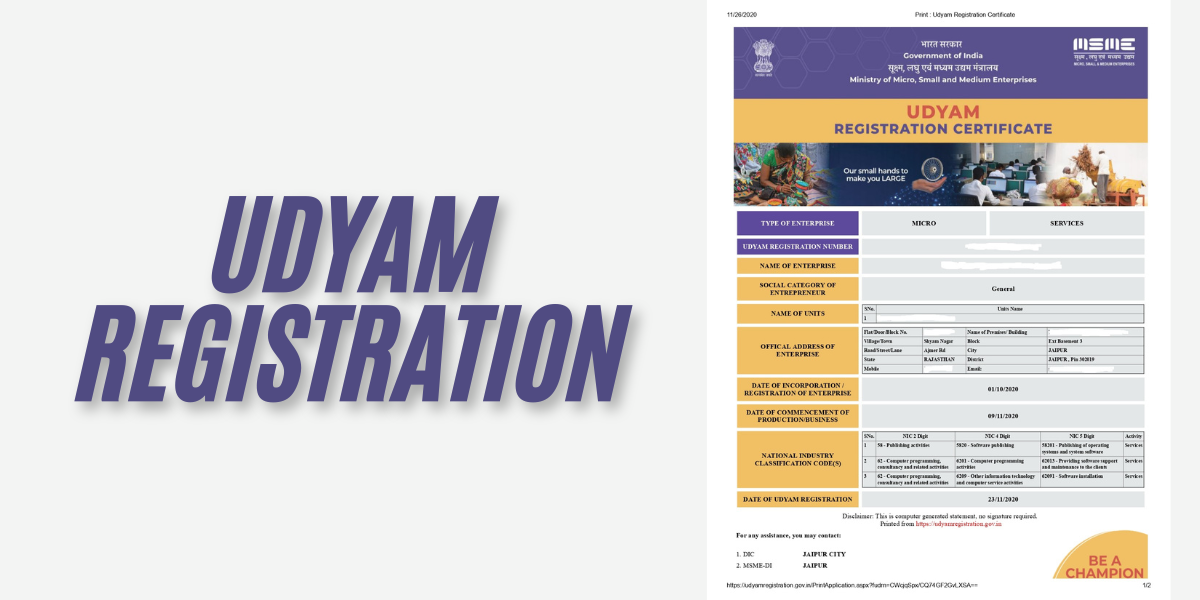

How to Download Udyam Registration Certificate?

You can print your Udyam Registration from the official website after successful Udyam-registration. It requires only a few steps to proceed with it

Visit the website of Udyam-Registration to get to the Homepage of the same

After coming to the Homepage find the ‘Print Certificate’ Option and click.

After filling out the required details, enter your Udyam-Registration Number with your Mobile Number that you filled in at the time of registration. Ensure the entered details are correct.

After all the above processes, you should click on the ‘Download’ button. Now, your Udyam-Registration Certificate will be displayed before you and you can download or print the same for further reference.

How to Check Udyam-Registration Status?

To check the status of your Udyam-Registration, follow the steps below.

- Visit the Udyam-Registration Portal.

- Click on ‘Verify Udyam-Registration’.

- Enter your Udyam Number.

- Click on ‘Submit’ to view your registration status.

FAQs on Udyam Registration

1. Is Udyam-Registration Mandatory?

Yes, if your business falls under the MSME category, it is mandatory to register under Udyam to avail of government benefits.

2. Can I Update My Udyam-Registration Details?

Yes, you can update your details on the Udyam Portal by logging into your account.

3. Is Udyam-Registration Free?

Yes, the registration process is free of cost on the official portal. Be cautious of websites that charge a fee for registration.

Key Benefits of Udyam-Registration for MSMEs

| Benefit | Description |

| Government Subsidies | Avail various government schemes and incentives. |

| Easy Bank Loans | Loans at reduced interest rates for registered MSMEs. |

| Tax Exemptions | Avail tax benefits and exemptions. |

| Market Support | Get protection of delayed payments, legal support etc. |

Conclusion

Udyam Registration is quite an important for MSME in order to get their government benefits in business. The process is simple as well as avails several benefits such easy loans, Tax benefits, Subsidies etc. Now, you also get your business on the Udyam Portal; hence, safe future for it and eligible towards all the different schemes of governments.

Make sure to complete your Udyam-Registration today and enjoy the benefits it offers for your business growth.

Read More Blogs:-