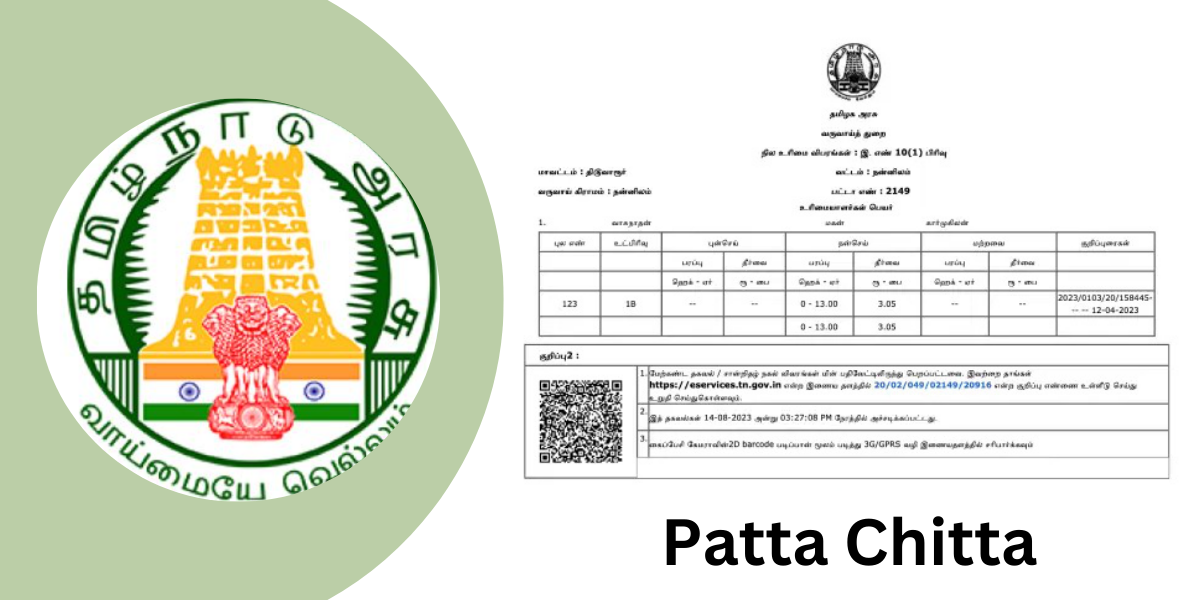

Patta Chitta is the most important document for any owner of land in Tamil Nadu. It holds the information regarding land ownership, the type of property, and even revenue records. The government of Tamil Nadu has further eased access to these documents through an official portal where you can have your patta certificate, chitta extract, or any other land record in just a few minutes.

Everything about Patta Chitta, including its application process, importance, and the latest update, is here in this guide.

What are Patta and Chitta?

Let’s get started with a little definition on what Patta and Chitta stand for:

- Patta: A legal document carrying information related to the ownership of land. These include owner name, survey number, and the type of land (dry or wet).

- Chitta: It is a record of land revenue that contains the details about area, size, and classification of the land. It also contains whether the land is for agriculture or non-agriculture purpose.

Both of these documents are used for property transactions and legal verification in Tamil Nadu.

Difference Between Patta and Chitta

| Area of comparison | Patta | Chitta |

| Meaning | Ownership record of the land Land | revenue record |

| Contains | Owner’s name, survey number, land type | Area, size, classification of the land |

| Purpose | Serves as proof of ownership of the property | Indicates on how the land is used |

| Issued By | Revenue Department | Village Administrative Officer (VAO) |

Why is Patta Chitta Important?

Patta Chitta documents are important.

Chitta patta is a document required by a landowner in Tamil Nadu. It proves ownership and assures legal rights over a particular piece of property to help resolve disputes too.

In any property dealing, these documents are necessary for the legitimate and legal selling or purchasing of land. In case of conflicts, their legal verification is needed to validate ownership and details related to land.

Chitta patta is crucial for accessing government schemes that benefit landowners. Additionally, banks demand these documents when applying for loans against property, as they verify ownership before approving loans.

How to Check Patta Chitta Online?

Check Patta Chitta online on the official Tamil Nadu government portal with these steps.

Step 1: Visit the Official Portal, Access the Tamil Nadu e-Services portal at https://eservices.tn.gov.in.

Step 2: Click on ‘Patta & FMB / Chitta / TSLR Extract’

Click on the option which says ‘Patta & FMB / Chitta / TSLR Extract’ on the homepage.

Step 3: Fill up the details

- District

- Taluk

- Village

- Survey Number

- Subdivision Number

Step 4: Click on ‘Submit’

After filling up the details, click on the ‘Submit’ button.

Step 5: View and Download chitta patta The system will show your Patta Chitta record. You can download or print it for future use.

How to Apply for Patta Chitta Offline?

If you want to go through the offline process, then follow these steps:

- Visit the local Tahsildar’s office.

- Fill up the application form for Patta or Chitta.

- Submit all the necessary documents like proof of ownership, ID proof, and address proof.

- Submit the form and pay the application fee.

- Collect your chitta patta certificate once it is processed.

Documents Required for chitta patta Application

You will need the following documents to apply for Patta Chitta:

- Sale deed copy

- Property tax receipts

- Encumbrance certificate

- ID proof (Aadhar, Voter ID, etc.)

- Address proof

Latest News on Patta Chitta (January 2025)

The latest news about chitta patta involves the following:

In December 2024, the Tamil Nadu government has launched a mobile app to view the chitta patta records.

November 2024, The online mutation process has been streamlined and the time taken to update land records is now less.

October 2024, A grievance redressal system has been started by the government for chitta patta applications.

September 2024, The online portal has new security features that prevent fraud.

Advantages of Checking Patta Chitta Online

It is convenient because you can check land records from anywhere, at any time.

- Time-Saving: The online process is faster and more efficient than visiting government offices.

- Transparency: The portal ensures transparency in land records.

- Cost-Effective: It reduces the need for middlemen and agents.

- Real-Time Updates: You get instant updates on your land records.

Common Issues and Solutions

Issue: Forgot Login Credentials

Solution: You can use the ‘Forgot Password’ option to reset it.

Issue: Incorrect Land Details

Solution: You can file a grievance online to get it corrected.

Issue: Unable to Access the Portal

Solution: Ensure you have a stable internet connection.

Contact Information for Patta Chitta Services

In case of any problem, you can contact the Tamil Nadu Revenue Department at the following number:

- Helpline Number: 1800-102-5161

- Email ID: eservices@tn.gov.in

- Address: Commissionerate of Revenue Administration, Tamil Nadu

How to Use chitta patta Portal

Maintain Your Login Credentials Safe: Do not let anyone know your username and password.

- Use Latest Browser: Upgrade your browser so that you don’t face technical problems.

- Check Notifications: Always look for notifications and announcements on the portal.

- Download Important Documents: Always save a copy of your land records.

Conclusion

The Patta Chitta portal is a revolutionary step by the Tamil Nadu government to simplify land record management. It provides easy access to property details, making it convenient for landowners, buyers, and legal professionals. By using this portal, you can save time, reduce paperwork, and stay updated on your property information. It has everything, whether it is a chitta patta check, an application for Patta, or updating your property details.

Do not forget to visit the portal frequently so that you may know the information regarding your land and handle the land records in an effective way.

Read More Blogs:-

MOHELA Student Loan Login Portal